Imagine having a high-performance sports car, powerful and ready to conquer any road. Now, imagine its windshield is completely foggy. Would you dare to push its limits, accelerating into unknown territory? Most people wouldn’t drive a car at full speed in those conditions.

Similarly, most organizations cannot run their business without clear financial visibility.

Unlocking Deeper Value from Your Workday Financials

Workday Financials is a powerful platform for modern enterprises, unifying accounting, revenue, expenses, and operational data into a single, comprehensive system. Yet, the true power of any financial system isn’t just in its ability to process transactions; it lies in its capacity to transform raw data into actionable insights.

According to APQC’s Open Standards Benchmarking® data in general accounting and reporting, bottom performers (represented by organizations at the 75th percentile) need almost four times the headcount of top performers (organizations at the 25th percentile) to perform financial reporting. This gap demonstrates that top performers handily outshine their peers and competitors when it comes to labor productivity.

This is where having a well-designed financial reporting environment becomes important. Accountants and Business leaders need clear, reliable, timely, and accessible reports. Even the most sophisticated financial data remains untapped unless the users gain access.

At Teamup9, we understand that your Workday Financials implementation is a significant investment. Many deployments focus on the basics: Transactions, Security, Worktags and Business Processes. Despite its immense importance, Reporting is frequently de-prioritized and sometimes even cut from scope. This can lead to user frustration and system disappointment.

Understanding the data model and how it translates from a business perspective can be daunting. Additionally, navigating the many technical options such as advanced report, matrix and composite reports, Prism, Discovery Boards, Worksheets and OfficeConnect can be overwhelming.

To ensure you’re maximizing your potential, a Financial Reporting Health Check can be beneficial. It helps you move beyond basic data presentation to truly intelligent financial management.

The Criticality of Performance and Distribution

Beyond the content of your reports, their performance and distribution are critical factors in their effectiveness. A report loses its value if it takes too long to run, causing delays in crucial decision cycles. Slow report generation can frustrate users, lead to workarounds, and ultimately diminish trust in the system. Optimizing report performance involves reviewing underlying data models, calculation efficiency, and report design best practices to ensure insights are delivered swiftly.

Equally important is report distribution. Getting the right information to the right stakeholders at the right time is key. Are your critical financial reports being automatically scheduled and delivered to relevant department heads, executives, or external auditors? Or are teams manually pulling and sharing data, risking outdated versions and information silos? Efficient distribution mechanisms, including scheduled reports, alerts, bursting and subscriptions within Workday, ensure that financial intelligence flows seamlessly across your organization, empowering timely and informed action.

Enhancing User Experience with Dashboards and Hubs

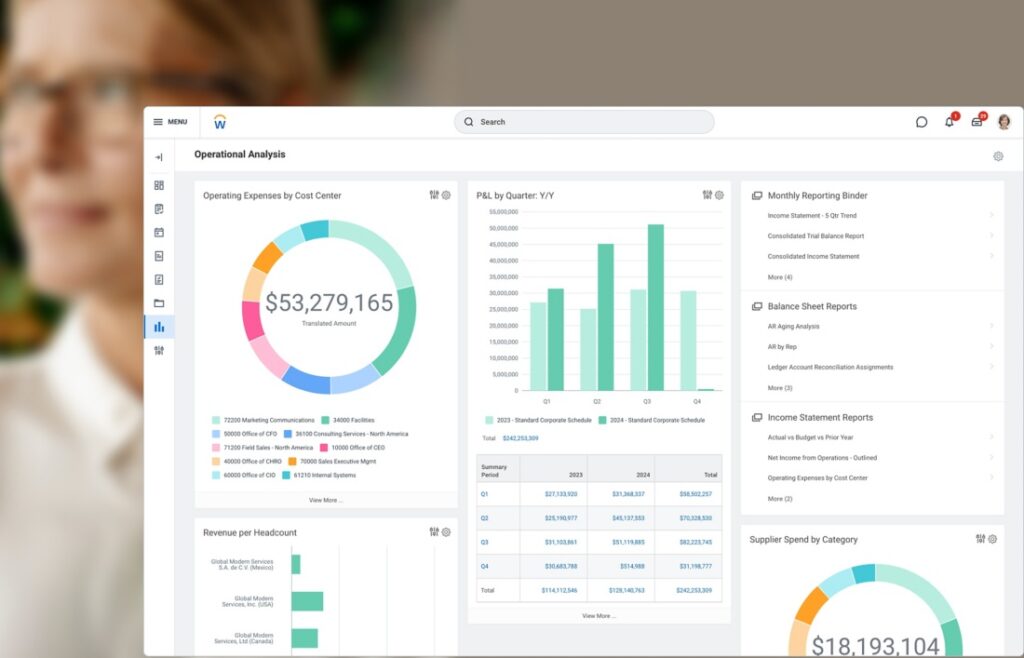

For financial reporting to drive value, it must be intuitive and accessible to its users. Workday excels in this area with its customizable dashboards and hubs, which transform static data into dynamic, interactive experiences. These interfaces empower users to gain insights at a glance, reducing reliance on traditional, often overwhelming, reports.

Key benefits of a well-designed dashboard and hub experience include:

- Real-time Insights: Dashboards provide up-to-the-minute views of key financial metrics, allowing for immediate understanding of performance.

- Personalized Views: Users can tailor dashboards to their specific roles and responsibilities, focusing on the data most relevant to their decisions.

- Interactive Drill-Down: The ability to click on a summary number and drill down to the underlying transactional detail fosters deeper understanding and trust in the data.

- Reduced Report Dependency: Many common questions can be answered directly from a dashboard, minimizing the need to run multiple, complex reports.

- Improved Data Literacy: An intuitive user experience encourages more employees to engage with financial data, fostering a data-driven culture.

- Centralized Access: Hubs act as single points of entry for all relevant financial information, streamlining navigation and discovery.

By prioritizing user experience through well-crafted dashboards and hubs, you ensure that financial data is not just available, but truly consumable and actionable for everyone who needs it.

Partnering with AMS for a Financial Reporting Health Check

Given the complexities of Workday Financials and the critical role of reporting, engaging an experienced Application Management Services (AMS) provider like Teamup9 for a Financial Reporting Health Check is a strategic move. Our experts can provide an objective, in-depth assessment of your current reporting landscape.

A comprehensive health check typically involves:

- Understanding your requirements: By listening to you and learning about your organization, we can translate business requirements to report needs.

- Review of Existing Reports: Assessing the efficiency, accuracy, and relevance of your current report inventory.

- Performance Optimization: Identifying and resolving bottlenecks that cause slow report execution.

- Data Quality Analysis: Pinpointing underlying data issues that may compromise report integrity.

- Security and Access Audit: Ensuring that sensitive financial data is only accessible to authorized personnel.

- Distribution Effectiveness: Evaluating how reports are shared and recommending improvements for timely delivery.

- User Experience Assessment: Analyzing current dashboard and hub utilization and suggesting enhancements for better user adoption and insight.

- Future-State Roadmap: Providing actionable recommendations and a strategic plan for optimizing your financial reporting capabilities, including leveraging new Workday features or advanced analytics.

At Teamup9, our experienced team members have successfully guided hundreds of customers in understanding and optimizing their reporting infrastructure. With a keen eye on business objectives and a strong commitment to mentoring administrators, an engagement with us can be the transformative change your organization needs

By proactively investing in a Financial Reporting Health Check, you ensure your Workday Financials system is not just operational, but optimally configured to deliver the precise, timely, and user-friendly insights necessary to your organization. It clears the view to allow you to chase your vision at full speed.