Transforming Your Finance Operations with Workday Adaptive Planning

Are your finance teams still wrestling with unwieldy spreadsheets, battling version control issues, and spending more time on data reconciliation than strategic analysis? Traditional planning methods often fall short, hindering agility and delaying critical decision-making. According to APQC, there a a number of key performance indicators that measure the planning process such as “Total cost to perform planning, budgeting, and forecasting per $1,000 revenue” and “Cycle time in days to update/revise the rolling forecast”

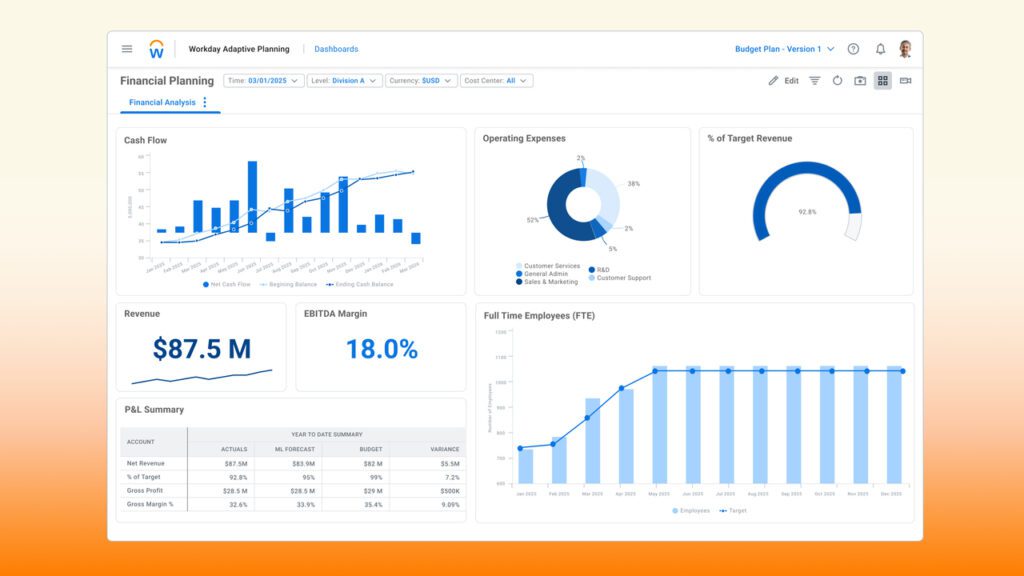

This is where Workday Adaptive Planning (formerly Adaptive Insights) emerges as a game-changer, seamlessly integrating with Workday Financials to provide a modern, comprehensive solution for financial planning and analysis (FP&A).

At Teamup9, we understand that finance leaders need more than just numbers; they need actionable insights. Workday Adaptive Planning empowers finance teams to move beyond reactive reporting to proactive, intelligent planning, driving performance and fostering true business partnership.

Use Cases and Core Benefits for Finance Teams

Workday Adaptive Planning offers a unified platform that supports a wide array of financial planning and reporting use cases, dramatically improving efficiency and accuracy.

Key Use Cases:

- Comprehensive Budgeting & Forecasting: From annual budgets to rolling forecasts and re-forecasts, Adaptive Planning provides the flexibility to model financial scenarios with precision.

- Workforce Planning: Integrate HR data to accurately plan for compensation, headcount, and talent costs, aligning people strategy with financial goals.

- Sales & Revenue Planning: Connect sales pipeline data to create robust revenue forecasts and analyze sales performance against targets.

- Capital Expenditure Planning: Manage and track capital investments, assessing their impact on cash flow and profitability.

- Scenario Modeling: Rapidly create and compare multiple “what-if” scenarios to understand potential outcomes and guide strategic choices.

- Financial Reporting & Analysis: Generate dynamic financial statements, management reports, and variance analyses with drill-down capabilities.

Benefits of Adaptive Planning for Finance Teams (especially over Excel)

Moving from spreadsheet-based solutions to an agile planning solution provides significant tangible benefits.

- Enhanced Collaboration & Version Control: Say goodbye to “Budget_vFinal_v2_reallyfinal.xlsx.” Adaptive Planning provides a single source of truth, allowing multiple users to collaborate in real-time on the same model without overwriting data or creating conflicting versions.

- Superior Data Integrity & Accuracy: Automated data flows and built-in validation rules drastically reduce manual errors, ensuring the reliability of your financial data.

- Scalability & Performance: Unlike spreadsheets that buckle under large datasets, Adaptive Planning is built for enterprise scale, handling vast amounts of data and complex calculations with speed and efficiency.

- Robust Auditability: Every change is tracked, providing a clear audit trail that enhances transparency and compliance.

- Dynamic Reporting: Create interactive reports and dashboards that allow for immediate drill-down into underlying data, moving beyond static numbers to deep insights.

Implementation Considerations and Seamless Integrations

Implementing Workday Adaptive Planning requires thoughtful consideration of how your financial data is structured and flows. Key aspects include:

- Planning Dimensions: Defining your planning dimensions (e.g., departments, cost centers, projects, products) is crucial for granular analysis and reporting. A well-designed dimensional model ensures you can slice and dice data in meaningful ways.

- Currencies: For global organizations, Workday Adaptive Planning seamlessly handles multi-currency planning and consolidation, simplifying complex international financial operations.

- Time Periods: The platform offers flexible time periods, allowing you to plan and report across various horizons (e.g., weekly, monthly, quarterly, annually) and easily compare actuals to plans.

One of the most powerful features is its native integration with Workday Financials. This allows for a seamless, automated flow of actuals data from your General Ledger, Expenses, Procurement, and other Workday modules directly into your planning models. This real-time synchronization eliminates manual data exports and imports, ensuring that your variance analysis is always based on the most current information.

Intelligent Planning and Self-Sufficiency

Beyond core planning capabilities, Workday Adaptive Planning is at the forefront of intelligent planning, leveraging AI-driven insights to enhance forecasting accuracy. AI can analyze historical data, identify trends, and even detect anomalies, providing predictive forecasts that reduce guesswork and improve the reliability of your plans. This moves finance teams from descriptive analytics (“what happened?”) to more prescriptive insights (“what should we do?”).

Crucially, Workday Adaptive Planning is designed for self-sufficiency and administration by finance teams. Once implemented and configured by experts like Teamup9, finance professionals can own their planning models, create and modify reports, and build custom dashboards without heavy reliance on IT. This empowers the finance function to be more agile and responsive to business needs, truly becoming strategic partners.

Conclusion

Workday Adaptive Planning is more than just a budgeting tool; it’s a comprehensive platform that transforms financial planning and reporting. By providing robust use cases, significant benefits over traditional methods, seamless integration with Workday Financials, and intelligent, AI-driven insights, it empowers finance teams to achieve unprecedented levels of accuracy, efficiency, and strategic foresight. Partnering with Teamup9 ensures your implementation is optimized for long-term success, enabling your finance organization to drive value and navigate the future with confidence.