For many Controllers, the period-end close is more than just a deadline; it is a monthly marathon characterized by manual reconciliations, spreadsheet-heavy journals, and a high-stress environment for the accounting team. When financial data is scattered across sub-ledgers and disparate systems, the “last mile” of finance—the process of turning raw data into consolidated financial statements—becomes a significant operational bottleneck.

The modern Controller’s goal is to move away from being a “historian” who spends three weeks of the month simply assembling the past. Instead, the focus is on “Continuous Accounting,” where the books are essentially always ready, allowing the team to spend their energy on ensuring accuracy, managing risk, and providing high-value analysis to the rest of the organization.

Moving Toward Continuous Accounting

The traditional close process is often delayed by “surprises”—unreconciled accounts, missing intercompany entries, or data errors discovered only during the final consolidation. Workday changes this dynamic by providing a unified architecture. In Workday, there are no sub-ledgers to reconcile to a general ledger. When a transaction happens in procurement or billing, it reflects in the ledger immediately.

This “always-on” ledger allows for a shift toward continuous accounting. Rather than waiting for the end of the month to perform reconciliations or data validations, these tasks can be automated or handled as they occur. This not only speeds up the timeline but also significantly reduces the risk of error, as issues are identified and resolved in real-time.

The Controller’s Toolkit for a Controlled Close

Workday provides a specific suite of tools designed to automate the most time-consuming parts of the accounting cycle. By leveraging these modules, Controllers can replace manual checklists with automated workflows:

- Workday Close: This feature acts as a centralized command center. It provides real-time visibility into the status of every closing task across all global entities, allowing you to manage dependencies and identify bottlenecks before they cause a delay.

- Unified General Ledger (GL): Because all financial data lives in a single ledger, the need for time-consuming sub-ledger-to-GL reconciliations is eliminated.

- Workday Accounting Center: This is a game-changer for high-volume industries. It ingests large volumes of data from external systems (like point-of-sale or specialized banking platforms) and automatically transforms it into accounting journals based on your specific rules.

- Automated Intercompany Netting: Workday handles intercompany eliminations and netting automatically as transactions occur, ensuring that consolidated results are accurate at any point in the month.

- Embedded Internal Controls: Instead of managing controls in a separate document, controls are built into the Workday workflow. Every journal entry has a clear, unalterable audit trail, and approvals are routed automatically based on your organization’s policy.

Measuring Success: KPIs for the Modern Close

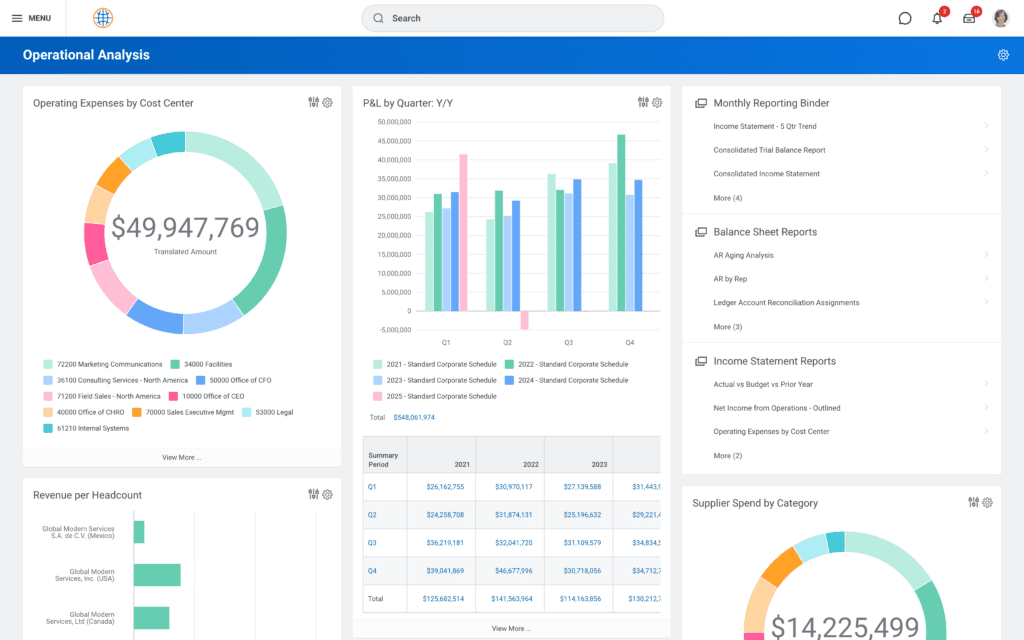

A successful Workday implementation for the Controller’s office should result in measurable improvements in efficiency and accuracy. By tracking these Key Performance Indicators (KPIs), you can demonstrate the tangible value of your digital transformation:

| KPI | Outcome with Workday |

| Days to Close | Reduced from weeks to days by eliminating manual data entry. |

| Manual Journal Entries | Significant reduction through automated system-generated journals. |

| Audit Adjustment Frequency | Lowered due to real-time validations and embedded controls. |

| Internal Control Pass Rate | Improved through automated audit trails and standardized workflows. |

Conclusion: Beyond the Faster Close

The real victory for a Modern Controller isn’t just closing the books in three days instead of ten; it’s the quality of life for the team and the integrity of the data. When the mechanical aspects of the close are automated, the accounting team can pivot from data assembly to data analysis. You move from simply reporting the numbers to explaining the “why” behind them, providing the CFO and the board with a foundation of trust.

Take the Next Step

Is your team still “battling the close” every month, or are you moving toward a continuous, controlled accounting model? Teamup9 specializes in helping Controllers optimize their record-to-report process, ensuring your Workday environment is configured to deliver speed, accuracy, and total auditability.

Would you like us to perform a health check on your current Workday Close configuration?